As veterans take turns to go on a relay hunger strike across India and mainly at Delhi’s Jantar Mantar over the non-implementation of the ‘One Rank One Pension’ demand, I went looking for the so-called complicated and tedious formula that has apparently kept the government tied up in knots.

After talking to experts and pouring over many documents—not my cup of tea really, but I thought I owed it to my father who retired in May 1982 as a Subedar Major and who checks with me every week whether OROP will ever be implemented—I have managed to conclude that all arguments about burgeoning defence pension bill being un-affordable to the government is nothing but a myth.

Let me explain.

Before proceeding further however, it must be clarified that the current defence pension expenditure of Rs 54,500 crores (2015-16) also includes defence civilians who approximately number 400,000.

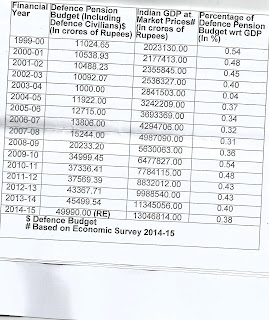

Now, the perceived exponential rise in pension bill needs to be put in the correct perspective. The figure would rise in absolute numbers of course but when viewed as a percentage of the nation’s GDP, the expenditure on defence pension shows an overall declining trend as the table below will illustrate:

The defence pensions as a percentage of GDP thus shows a clear long term declining trend despite an absolute rise in numbers (the spike in 2009-10 was due to payment of arrears for years 2006, 2007 and 2008 after the award of the 6th pay commission).

Now why does the military have higher number of pensioners as compared to their civilian counterparts? Simple. The nation needs a young army and therefore soldiers are recruited young and retired early (most of them between 34-37 years). On the contrary, all non-military government employees (including jawans of the Central Armed Police Forces—CAPFs) have the luxury of serving till the age of 60. The ratio of pensioners to serving personnel in the military is thus 1.7:1 as against 0.56:1 among the civilians. But that’s the price the nation needs to pay for maintaining a standing army.

Had the long-standing recommendations for lateral absorption of this vast, disciplined and ready made pool of manpower in various non-military organisations been implemented, perhaps the pension bill could have been reduced but that has not happened because of lack of political will and bureaucratic resistance.

There is one more reason why the military pension bill will further reduce in terms of percentage of the GDP: All civilians in defence ministry who joined service on or after 1 January 2004, have now come under the ambit of the contributory National Pension Scheme (NPS). Soldiers unfortunately cannot be brought under the ambit of the NPS because of their short service span. The benefit of NPS, it should be noted, accrues over a long span of time (30 years or more) deriving the benefit from the power of compounding the accrued amount!

Now to the second part of the entire issue: the complexity of calculations.

The format of the existing pension tables issued by the government gives pension of a soldier based on two variables – his rank and length of service. The pension for a given rank for higher length of service will be higher. Hence, if a Sepoy gets Rs 5,480 as pension on retiring at 17 years of service, a Sepoy retiring at 18 years of service would be getting pension higher than Rs 5,480. Ideally, the pension of a Sepoy retiring at 18 years of service should be 3 per cent higher, i.e Rs 5,614. But due to various reasons the difference is invariably not three per cent. It is due to this anomalous situation that annual reviews are required for OROP which will have additional financial implication. However, the outgo for government will decline with each subsequent annual review and in steady state will be almost zero, when for a particular rank, pensions for each year of service will be approx three per cent higher than preceding year of service.

How pension Bill will actually decline

Bunching Effect Will Peter Out. Bunching of salaries, and hence pensions, for a particular rank happens for a number of reasons. Bunching implies same salary, and hence pension, for a particular rank even with different years of service, despite the Running Pay Band System introduced by 6th Central Pay Commission—CPC–(salary increases automatically with three per cent annual increment in Running Pay Band System; hence higher salary for higher number of years of service).

For example, take the case of Majors, with 13, 14, 15, 16 years of service in December 2004. When Lt Col was made a non-selection grade rank (earlier selection grade rank around 16-18 years of service) in 13 years of service, all Majors with service higher than 13 years were made Lt Cols together on the same date and fixed into the same 5th CPC pay scale of Lt Col. Their replacement scales in 6thCPC, hence, were also same. Now these Lt Cols (if not promoted to Col subsequently) of different years of service will keep getting same pay of Lt Col/ Col (Timescale–TS) till they retire; they will get same pension on retirement also. Once OROP is implemented, pension figures of the rank of Col (TS) for years 30, 31, 32, 33 years (they may reach retirement age of 54 in different years) may be same instead of being separated by approx three per cent annual difference. Now if, annual review of OROP tables is carried out, using these ‘Bunched Up’ pension figures, the pension for Col (TS) of 33 years will be higher than Col (TS) of 33 years of previous year’s OROP table by approximately three per cent since the erstwhile year’s serving Col of 32 years will get three per cent increment and may retire with three per cent higher pension in 33 years.

Here is another example. In the 5th pay commission, a Naik used to get an annual increase of Rs 85. However, post the 6th Pay Commission, the annual increment is three per cent of Basic Pay plus Grade Pay which is much higher i.e, approximately Rs 300. Thus, a Naik with 19 years of service who was enrolled in year 1996 (5thPay Commission regime) would have got 10 annual increments at lower 5thPay Commission rate and nine higher increments in 6th Pay Commission scale. On the other hand, a Naik who was enrolled much later say in the year 2000, has just 6 lower rate annual increments in his salary and nine higher rate annual increments. Thus, rate of salary progression for this Naik (2000 entry) is higher; when these two Naiks retire (in different years) after completing 24 years of service, the pay and pension figure of Naik (2000 entry) will be higher. Thus annual revision of OROP table will lead to a higher pension figure for a Naik of 24 years of service when Naik (2000 entry) retires. This effect will get ‘damped’, as time progresses in the regime of any pay commission.

There are many other reasons for declining additional financial implication for annual review of OROP tables, but the two major reasons are listed above. Theoretically, if there are 300 Cells in the OROP table (10 Ranks as Column Heads, 30 Qualifying Service as Row Heads) and all 300 Cells are to be enhanced by three per cent next year, the additional financial implication will still be capped at three per cent. However, actually only few Cells may change through annual review of OROP tables and additional financial implication of each Cell may range from 0 to three per cent approximately. Hence, overall additional financial implications will be much lower than three per cent. It was actually mathematically computed as 0.85 per cent using CGDA (Comptroller General, Defence Accounts) data for JCOs/OR.

Experts say another way to comprehend the declining financial implication of annual review is to draw an analogy from the ‘Damping Out’ of a Sinusoidal Wave. Unless there is an external impulse, the sinusoidal wave gets damped out. Similarly, as Bunching Effect and other anomalies exit the system of pay and pensions, with no external impulse (i.e, change in terms and conditions of service), the additional financial implications of annual review of OROP will continuously reduce and in steady state will be almost zero.

So, all the arguments that the nation cannot afford the steadily increasing defence pension bill in the long run, is specious to say the least. If India wants to be strong, it needs a powerful military which acts as a deterrent against all adversaries. And if the nation needs a strong military, it is the obligation of the state to look after its soldiers—both serving and retired– reasonably well.

The Narendra Modi government will do well to remember that if it wants to be seen to be a friend of the soldier, there is no alternative but take a quick decision on OROP implementation. In a lighter vein, if that does not happen, my weekly call to my parents will invariably continue to begin with a question: What’s happening to OROP?

June 25, 2015 -

one question that also needs an answer shud the exservicemen be agitating when a first serious & gunine attempt is being made to address their legitimate demands ?shud not they have waited a little longer for the govt to work it out.

June 25, 2015 -

one question that begs an answer this agitation is it really justified. when a genuine serious attempt at addressing their legitimate denmand is being made, shud they have not displayed more maturity &waited say 30 or60days? this demeans them & gives a feel of politicking.

June 25, 2015 -

A nation aspiring to advance economically by accelerating production, by improving manpower utilisation,and by advancing in commerce and so on, a highly agile defence with morale is necessary!

June 25, 2015 -

Great & hats off to you.Hope some one from PMO reads this & put it up to the PM 🙂

June 25, 2015 -

In depth task of analysis and synthesis to quell the myth about and bogey of rise in pension bill of the defense veterans is highly appreciated. I wish it somehow reaches the concerned ministers.

June 25, 2015 -

we have been told this for 40 years

June 26, 2015 -

The Veterans wanted that some date should be announced. For which the Govt was not prepared.This creates the doubts in everybody's mind about the “INTENTIONS” of the Govt.Earlier also Honourable Raksha Mantri had announced the dates (31 Mar15 or Latest by end of Apr15).later on the Govt back tracked. Do you not think that at this stage the “CREDIBILITY” of the Govt is at stake????

June 26, 2015 -

Eyeopening article. Plse send it to IESM which will provide them ammuntion to fight the Babus on MoD

June 26, 2015 -

The Retd, Army officers are using words like “ supreme sacrifice” to get the support from the general public. This is a word used by foreign Armies. Their line of thinking is different from us. They think that Army job is the toughest and most risky .as compared to any other jobs. But Indian conditions are entirely different. This is a country of Mahatmas like Mahatma Gandhi. Swami Vivekananda and others..We have been taught in the younger age that a person should serve the country and the people without expecting anything in return.” Nishkam Karma, or self-less or desireless action is an action performed without any expectation of fruits or results, and the central tenet of Karma Yoga path to Liberation”. Along with Gandhi ji all freedom followed this without ant hesitation.. So they have done the Supreme Sacrifice not the Indian Army. Army people are getting remuneration for their work. Only thing is that they are not getting same pay as IAS officers, So let the Army people understand this and behave like a responsible citizens.Freed fighters got the pension after 50 years.

June 26, 2015 -

You have studied the issue in depth. And those who have been examining it for all these years could not be too oblivious. After all, as you quote, CGDA ( which should know what it is talking about) has estimated only 0.85 increase annually. But CGDA has only limited role in implementation. The Babus in Finance ministry are smart, Why did Mr Jaitley, earmark such a small amount in previous budget ( was he sleep or did he prefer to be sleep) ?. It was all a game plan to engineer an argument of financial difficulty. And remember, this incremental Jaitley is there to stay – at least till Mr Modi had enough of him. So wait.

June 28, 2015 -

Mr. Anil Kohli is, obviously, a civilian.Maturity to wait 30 – 60 days? Are you not aware that this legitimate demand has been made since the last 4 years ? Does patience have no limits? Successive politicians pay mere lip service, and then see that bureaucrats have them under their grip.